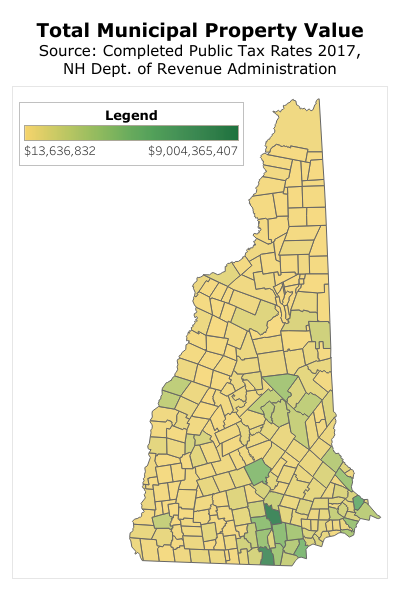

nh property tax rates by town 2020

The 2021 Equalization Ratio is 945. 2020 - 2021 City Millage Rates.

November 10 2020 - 1008am.

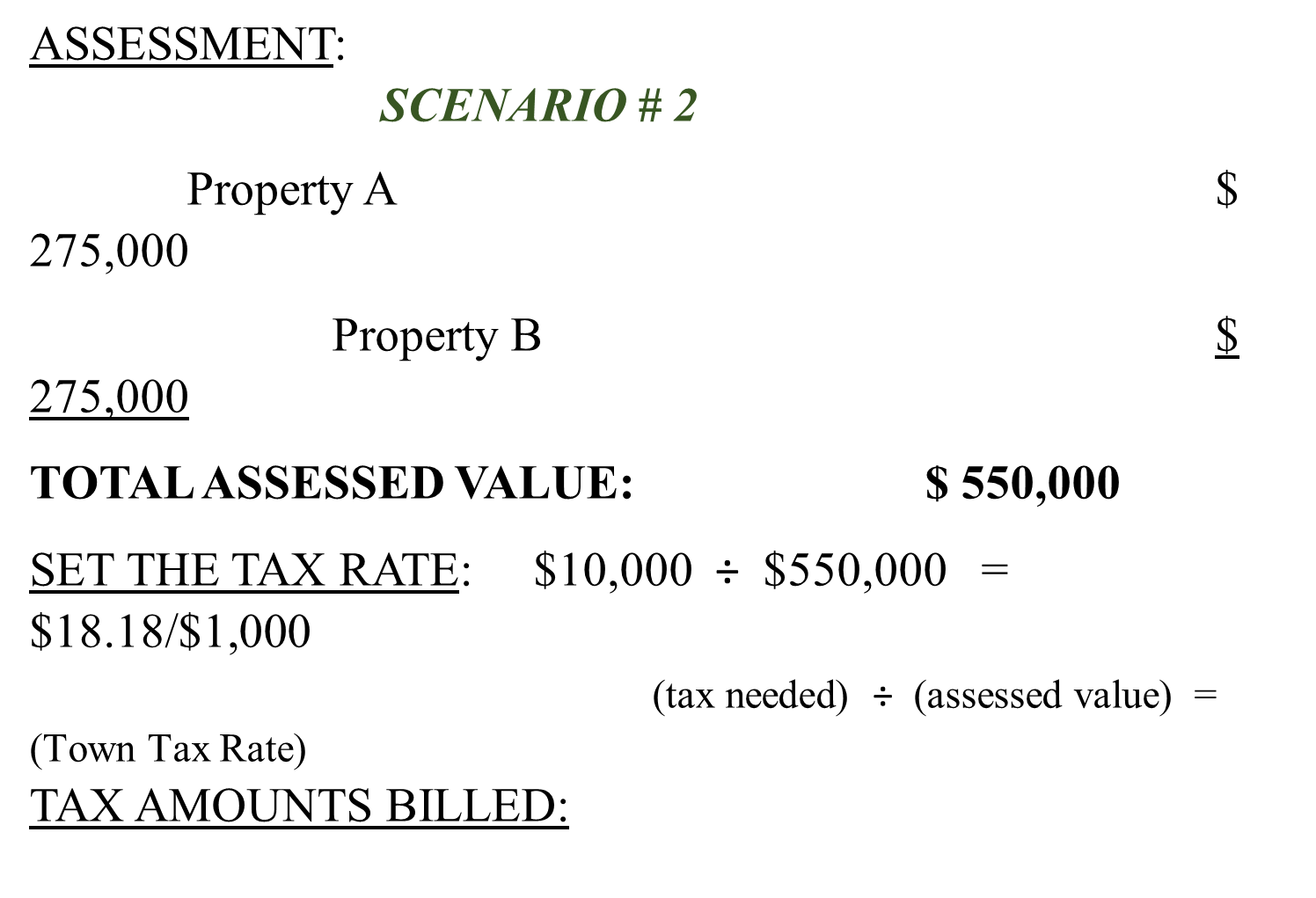

. Tax amount varies by county. Taxpayers are able to access property tax rates and related data that are published annually which is provided by the New Hampshire Department of Revenue Administration. The 2020 tax rate is 1470 per thousand dollars of valuation.

100 rows 2020 New Hampshire Property Tax Rates Updated. Revaluation of Property and the Tax Rate Setting Process. The 2020 tax rate is 2313 with an equalization rate of 913.

The new tax rate has been set by the state - 1950 per thousand of your assessed value. Claremont has the highest property tax rate in New Hampshire with a property tax rate of 4098. Evaluate towns by county and compare datasets including Valuation Municipal County Rate State and Local Education tax dollar amounts.

The 2018 tax rate is 2940 with an equalization rate of 779. The local tax rate where the property is situated For example the owner of a home. The NH Department of Revenue Administration has finalized the Towns 2020 tax rate and the rate for 2020 is 1876 per.

The New Hampshire Department of Revenue Administration has approved the Citys 2021 tax rate for Fiscal Year 2022 of 1503 per 1000 of valuation. The assessed value of the property 2. That is an increase of 066 or 35 compared to 2020.

2020 Town Meeting Results. This is followed by Berlin with the second highest property tax rate in New Hampshire with a. The following may be found at.

2021 - 2022 City Millage Rates. The Equalization Ratio for 2021 is 925 Property Tax Rates Historical view of rates. New Hampshire Property Taxes Go To Different State 463600 Avg.

2019 - 2020 City Millage Rates. Ghost gunner 3 firmware. Property tax bills in New Hampshire are determined using factors.

186 of home value Tax amount varies by county The median property tax in New Hampshire is 463600 per year for. 14 rows Rate Assessed Ratio. The 2019 tax rate is 3105 with an equalization rate of 753.

August 14 2022 Click here for a map with more tax rates NEW -- New Hampshire Median Rents by Town NEW -. Tax Collection Milford NH - New. Gail Stout 603 673-6041 ext.

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Tax Collector Town Of Hinsdale New Hampshire

Half Of Vermont Towns Will See Increased Property Tax Rates Vtdigger

Report School Funding Method Used Across N H Isn T Fair To Students Or Taxpayers

Information On Property Taxes Can Be Town Of Exeter Nh Facebook

State Corporate Income Tax Rates And Brackets For 2020

How Do State And Local Property Taxes Work Tax Policy Center

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Individual Income Taxes Urban Institute

The School Funding Commission S Report At A Glance Reachinghighernh

Tax Collector Town Of Nottingham Nh

Property Tax Comparison By State For Cross State Businesses

Nashua S Tax Rate Rises By 3 9 Covid 19 Brings Future Worries Nashua Nh Patch

Exeter 2021 Property Tax Rate Set At 24 01 1 000 Town Of Exeter New Hampshire Official Website

Property Tax Assessments Windham Nh

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Legal Q A Revaluation What Is It And How Does It Work New Hampshire Municipal Association